The economy shed 80,000 jobs in March, the third consecutive month of rising unemployment, presenting a stark sign that the country may already be in a recession.

The economy shed 80,000 jobs in March, the third consecutive month of rising unemployment, presenting a stark sign that the country may already be in a recession.Sharp downturns in the manufacturing and construction sectors led the decline, the biggest in five years. The Labor Department also said employers cut far more jobs in January and February than originally estimated.

There were fewer jobs in March than there had been five months earlier. In the last 50 years, whenever there has been an employment downturn like the one of the last few months, a recession has followed.

The unemployment rate ticked up to 5.1 percent from 4.8 percent, its highest level since the aftermath of Hurricane Katrina in September 2005. More Americans looked for work than in February, when many simply took themselves out of the job market. But employment opportunities appeared sparse, a thought echoed by some people looking for work.

Stock markets on Wall Street fell modestly in early trading, as investors hoped that the worst of the downturn was over.

Economists were less optimistic. The drop in payrolls was worse than feared: many analysts had expected a decline of 50,000 jobs and an unemployment rate of 5 percent.

“Three months in a row of payroll job losses and a sizable negative revision: these are clear signs that the job market is in recession,” said Jared Bernstein, an economist at the Economics Policy Institute. “I’m hard-pressed to imagine anyone who would raise doubt to that at this point.”

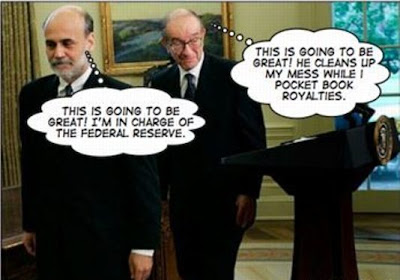

The employment report is considered the most important monthly indicator of the health of the economy. Many economists were already bracing for a poor report, and the chairman of the Federal Reserve, Ben S. Bernanke, told Congress earlier this week that the labor market would continue to soften.

The numbers suggest the Fed will extend its string of rate-cutting when it meets April 29. Investors expect central bankers to lower the benchmark interest rate by at least a quarter point, a move that can stimulate growth.

Wage increases continue to fall behind inflation, meaning many employees are actually earning less than a year earlier. Average hourly salaries ticked up 5 cents, or 0.3 percent, in March, and were running 3.6 percent higher than a year earlier. But consumer prices rose 4 percent over the same period.

As the housing slump erases home equity values and the crisis on Wall Street puts a crimp on the ability of businesses to lend, Americans from all walks of life are facing one of the most difficult job markets in years.

In March, private payrolls dropped for a fourth month, as factories, home builders and retail outlets all slashed positions. The only increases came in education and government jobs, as well as the leisure and hospitality industries.

Employers cut 76,000 jobs in January and February, far more than originally estimated.

In the Chicago area, the past year has brought shift eliminations at auto plants as well as layoffs in the manufacturing, construction and financial services industries.

George Putnam, an economist with the Illinois state government, said that when he talks with employers about hiring, he hears caution in their voices.

It is the same hesitation that has frustrated Gina Gerhardt, a 47-year-old mother of two, for more than three months. A resident of Lake Zurich, a northwestern suburb of Chicago, Ms. Gerhardt has been out of work since December, when she was laid off after six years as an executive assistant and project manager at a suburban roofing company.

Like many experienced workers who find themselves out of a job, Ms. Gerhardt said she has had trouble finding a position with a salary that would cover her bills. Her savings have nearly run dry, and she uses food stamps to buy her groceries.

“There are so many applicants out there. If they found my résumé out of the hundreds they get, it’d be a miracle,” she said.

Shabon Chadwick, 24, who lives in the Detroit suburb of Taylor, Mich., has had several part-time jobs since losing her position at a produce plant. But full-time work has remained out of reach, and she has been forced to borrow money from family members to keep up with her bills.

Michigan’s job market has been particularly battered by the recent downturn, as auto plants let go thousands of workers. Part-time work “is all you can find out here,” Ms. Chadwick said. “It makes me want to move out of Michigan because there are no jobs here.”

The downturn has even come to San Francisco, where highly trained workers with elite degrees flock to work for some of the world’s biggest technology companies. CNet Networks, the online media giant, laid off 10 percent of its staff — about 120 workers — this year in an effort to increase profitability and its share price. Yahoo, the search engine company, said it would cut its work force by 1,000.

Until recently, Parul Vora, 28, was earning a six-figure salary as part of an elite research team at Yahoo. Ms. Vora, who has a master’s degree from the Massachusetts Institute of Technology, lost her job in early February.

“I had never been laid off and never imagined being laid off,” Ms. Vora said. “I was sad personally and professionally.”

But Ms. Vora has better prospects than most. She said she has already been wooed by several potential employers.

“There are a lot of jobs out there, but I’m pretty picky,” Ms. Vora said. “My biggest worry is finding a new job I like.”

Source: www.nytimes.com

No comments:

Post a Comment